De sterke groei op de tweedehandsmarkt voor private equity investeringen heeft geleid tot innovatieve transactiestructuren. De aanhoudende ‘dorst’ naar liquiditeit heeft potentiële gevolgen voor alle private equity investeerders. Zoals vaker kan innovatie op financiële markten onvoorziene gevolgen met zich meebrengen.

Vervanging is inherent aan private equity. Zo dienen investeerders die blootstelling wensen aan de beleggingscategorie doorlopend nieuwe investeringsmogelijkheden te identificeren. Doorgaans committeert een investeerder (ofwel Limited Partner) zich om kapitaal gedurende een langjarige termijn (10-12 jaar) vast te zetten bij een fonds beheerd door een fondsmanager (ofwel General Partner). Tussentijds heeft de Limited Partner geen directe toegang tot het opgevraagde kapitaal. Indien de Limited Partner toch liquiditeit vereist, kan zij haar belang (deels) doorverkopen op de tweedehands (ofwel Secondary) markt.

Van simpele liquiditeitsoplossing…

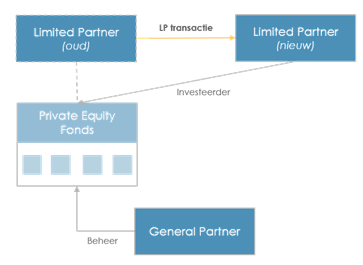

De Secondary markt wordt van oudsher voornamelijk gebruikt door Limited Partners om (een deel van) hun portefeuille vroegtijdig te liquideren (zie Figuur 1). Zij kiezen voor dergelijke transacties bij (i) een marginale restwaarde in het fonds, (ii) een behoefte aan liquiditeit of (iii) herbalancering van de portefeuille.

Figuur 1 – Voorbeeld structuur LP Secondary transactie

In 2022 was herbalancering bij 48% van de Limited Partner transacties de belangrijkste motivatie om te verkopen. Nadat prijsdalingen op de publieke markten leidden tot een verhoogde relatieve blootstelling aan private equity, gingen institutionele investeerders over tot verkoop van hun belangen om hun portefeuille te herbalanceren (het zogenaamde ‘denominator effect’).

… naar complexere transactiestructuren

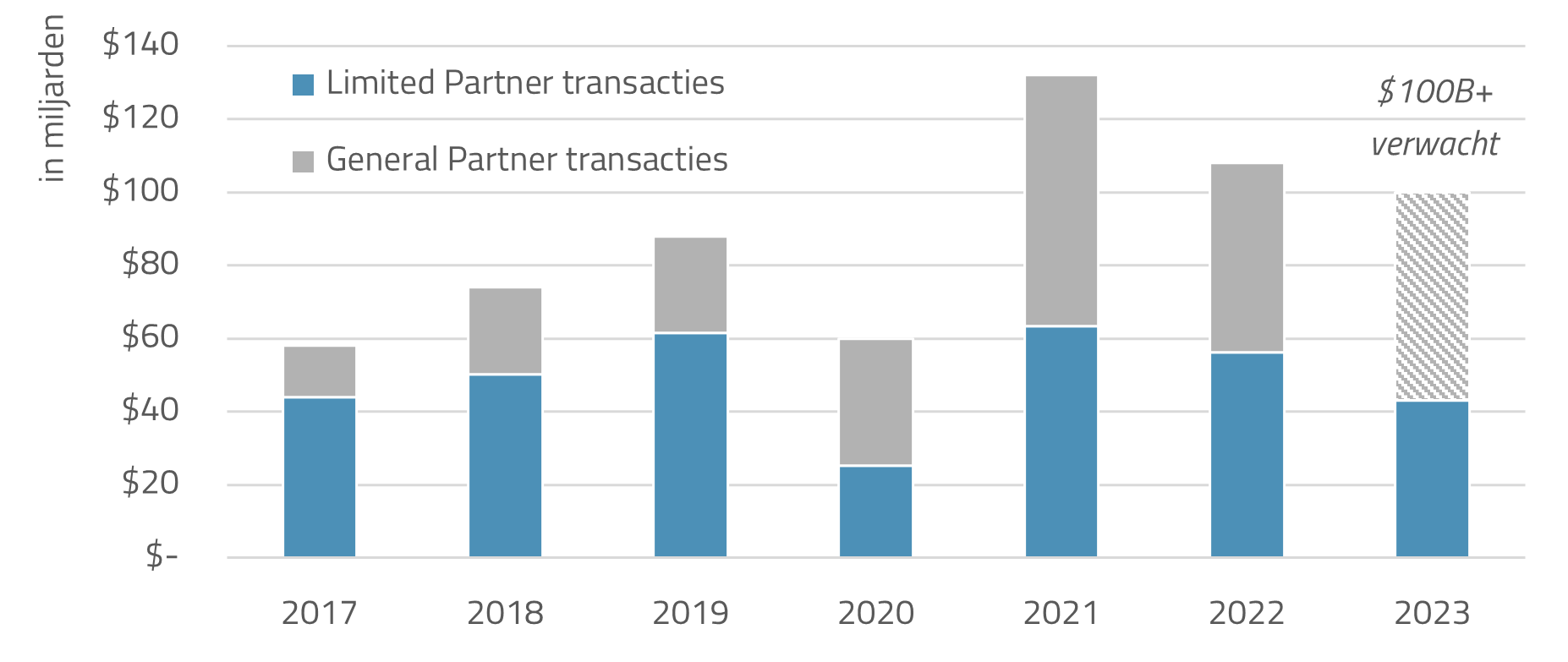

Naarmate de private equity industrie bleef groeien, ontwikkelde de Secondary markt zich als een bron van liquiditeit voor de General Partner zelf. Vroegtijdige liquiditeit voor fondsmanagers bleek namelijk waardevol wanneer men (i) aan het einde van de fondstermijn de resterende belangen in de portefeuille dient te verkopen of (ii) als de fondsmanager winsten wil realiseren én tegelijkertijd controle wil behouden, omdat het bedrijf in kwestie nog veel opwaarts potentieel heeft. Momenteel maken General Partner (ofwel GP-led) transacties ~50% uit van de totale Secondary markt (zie Figuur 2).

Figuur 2 – Secondary transactievolume (bron: Jefferies 2023).

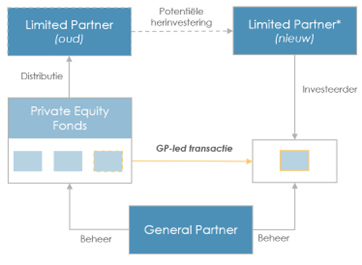

Een bekend voorbeeld is Action. De van oorsprong Nederlandse koopjesketen kwam in 2011 in handen van een private equity fonds van het Britse 3i. Hoewel het grote succes van Action een hoge potentiële winst kon opleveren, beoogde 3i langer te profiteren van het groeipotentieel van de onderneming. Daarom ging 3i in 2019 over tot een complexe transactie waarbij zij tegelijkertijd liquiditeit bood aan haar Limited Partners en zelf de zeggenschap hield (zie Figuur 3).

Figuur 3 – Voorbeeld structuur GP-led Secondary transactie. (*) Zowel oude Limited Partners als nieuwe kapitaalverschaffers (e.g. Secondary fonds)

Zodoende bieden GP-led transacties een oplossing voor fondsmanagers om liquiditeit te genereren. Bovendien hebben investeerders in het fonds de optie om door te investeren in het portefeuillebedrijf als zij dit verkiezen boven vroegtijdige liquiditeit. Daarmee lijkt het een win-winsituatie voor alle betrokken partijen. Echter, in de praktijk bestaan een aantal potentiële belangenverstrengelingen:

- Waardering: omdat de fondsmanager zowel de kopende als verkopende partij betreft, leidt dit tot conflicten over de prijs.

- Evaluatieperiode: waar de manager graag zo snel mogelijk een transactie wil sluiten, heeft de investeerder behoefte aan voldoende, vaak meer, tijd om de propositie te evalueren.

- Carried interest: eventueel uitgekeerde variabele vergoeding na de doorverkoop van het bedrijf vermindert mogelijk de alignment tussen de fondsmanager en de investeerder.

- Waardecreatie plan: tegen het einde van de fondstermijn kan een fondsmanager beoogde waardecreatie-initiatieven bij de deelneming uitstellen. Doordat de GP na de transactie een groter aandeel heeft in de deelneming, profiteert zij meer om de transformatie pas na de transactie uit te voeren.

Voor investeerders is een deel van de belangenverstrengelingen op te lossen door (i) een onafhankelijke waardering, (ii) een adequate besluitperiode en (iii) een bevestiging dat de fondsmanager haar carried interest herinvesteert in het bedrijf. Investeerders dienen er echter op te vertrouwen dat managers de implementatie van waardecreatie-initiatieven niet vertragen.

Is Pandora’s kruik geopend?

Volgens de Griekse mythologie was Pandora de eerste vrouw op aarde, gecreëerd door de goden. Ze kreeg een doos (of preciezer; kruik) die zij niet mocht openen, maar haar nieuwsgierigheid overwon en ze opende de kruik. Daarmee werd al het opgesloten kwaad verspreid over de wereld met enkel hoop die achterbleef. Vandaag de dag dient deze mythe als analogie voor situaties waar ogenschijnlijk onschuldige acties onbedoelde gevolgen hebben. Zo hebben de recente ontwikkelingen op de Secondary markt ook invloed op andere investeerders in private equity.

Allereerst gebruiken steeds meer General Partners Secondary transacties om liquiditeit in hun fondsstructuren te genereren. Investeerders in deze fondsen dienen daarbij te bepalen of zij hun belang willen ‘doorrollen’. Echter, vanwege de korte evaluatieperiode zijn veel investeerders niet in staat de transactie adequaat te onderzoeken. Ze gaan vervolgens over tot een ‘verplichte’ liquidatie. Hiermee missen zij mogelijk verder opwaarts potentieel.

Daarnaast verandert het risicoprofiel van investeringen in Secondary fondsen zelf. Zo leiden traditionele Limited Partner transacties tot breed gespreide portefeuilles met honderden onderliggende deelnemingen, terwijl GP-led transacties vaak geconcentreerder van aard zijn. Deze concentratie vergt meer capaciteit van de Secondary partij om gedegen onderzoek te doen naar de portefeuillebedrijven.

Al met al lijkt voldoende ‘hoop’ te resteren. Investeerders die in staat zijn de aangeboden ‘tweedehands’ transacties te evalueren kunnen potentieel waarde toevoegen aan hun portefeuille. Niettemin zal de evaluatie van Secondary fondsen in de toekomst meer aandacht vereisen. GP-led transacties hebben weliswaar bepaalde veranderingen teweeggebracht, maar voorlopig zal de impact beperkt blijven.

Daniël Helder

Augustus 2023