Private Equity wint aan populariteit. Niet verassend, gezien de goede rendementen die de beleggingscategorie in het verleden behaalde. Echter, anno 2023 ziet de markt voor private investeringen er een stuk minder rooskleurig uit. Is een herhaling van de gouden jaren wel realistisch?

“A rising tide lifts all boats”. Dit gezegde illustreert treffend de staat van de kapitaalmarkten, en private equity in het bijzonder, sinds de nasleep van de kredietcrisis De markt werd gekenmerkt door lage rentestanden, overvloedige kredietverstrekking en alsmaar stijgende waarderingen. Onder deze gunstige omstandigheden konden veel private equity managers zonder al te veel inspanning consistent betere resultaten behalen dan de publieke markten, vaak met behulp met hefboomfinanciering. Zo leverde de asset klasse sinds het begin van de 21e eeuw maar liefst 4-5% per jaar meer op voor investeerders vergeleken met beursgenoteerde aandelen. Afgelopen jaren stapten beleggers dan ook in met hoge verwachtingen. Maar tegelijkertijd maken kalme zeeën geen vaardige zeelieden. Het moet daarom nog blijken of deze verwachtingen kunnen worden waargemaakt.

Als gevolg van economische onzekerheid zijn de wateren waarin private equity zich begeeft onrustiger geworden. Toch tonen de kleurrijke pitchdecks van nieuwe fondsen dat managers nog steeds hoge rendementen verwachten. De door hen gestelde doelstellingen van een bruto rendement van drie keer de inleg en +25% IRR lijkt nog steeds eerder norm dan uitzondering. Is dit misleidend voor nieuwe beleggers? Of onderschatten we de wendbaarheid van de beleggingscategorie om zich aan te passen aan het veranderende tij?

Vier Ruiters van de Apocalyps

Het is begrijpelijk dat managers verwachte rendementen tonen om investeerders te overtuigen, vooral als ze een beperkte historie hebben op het gebied van succesvolle investeringen. Gelet op het afkoelende fundraising klimaat (ca. -20% daling in toegezegd kapitaal 2022 t.o.v. 2021) is het waarschijnlijk dat managers zullen doorgaan met het voorspellen van rustig vaarwater. Een viertal belangrijke ontwikkelingen plaatst echter vraagtekens bij de haalbaarheid van de hoge verwachte rendementen.

- Angst voor een economische crisis

- Instroom dry powder

- Hogere rentestanden

- Afkoelend exitklimaat

In het Nieuwe Testament symboliseren de Vier ruiters van de Apocalyps figuren die het einde der tijden voorspellen. Zijn bovenstaande vier ontwikkelingen deze ‘ruiters’ of is slechts een nieuw tijdperk voor private equity aangebroken? Deze ‘ruiters’ suggereren in elk geval dat het water waarin private equity zich begeeft woeliger is geworden. Hoe dienen investeerders bij dit nieuwe getij koers te houden?

Een gedisciplineerd allocatiebeleid en een optimale blootstelling aan private equity zijn essentieel binnen een bredere beleggingsportefeuille. Zo rekenen beleggers zich al snel rijk bij een goede prestatie van één van hun fondsen. Echter kan de eerder genoemde premie van 4-5% per jaar enkel worden behaald wanneer investeerders te allen tijde geïnvesteerd zijn in de asset klasse. Consistentie omtrent het allocatiebeleid is daarbij van groot belang. Deze onrustige wateren bieden namelijk ook kansen voor beleggers. Zo behoren de jaren direct na de kredietcrisis tot de beste die private equity heeft gekend. Van belang is uiteraard wel dat investeerders hun beleggingen spreiden over o.a. stijlen, type manager, sectoren en regio’s.

Selectiekracht

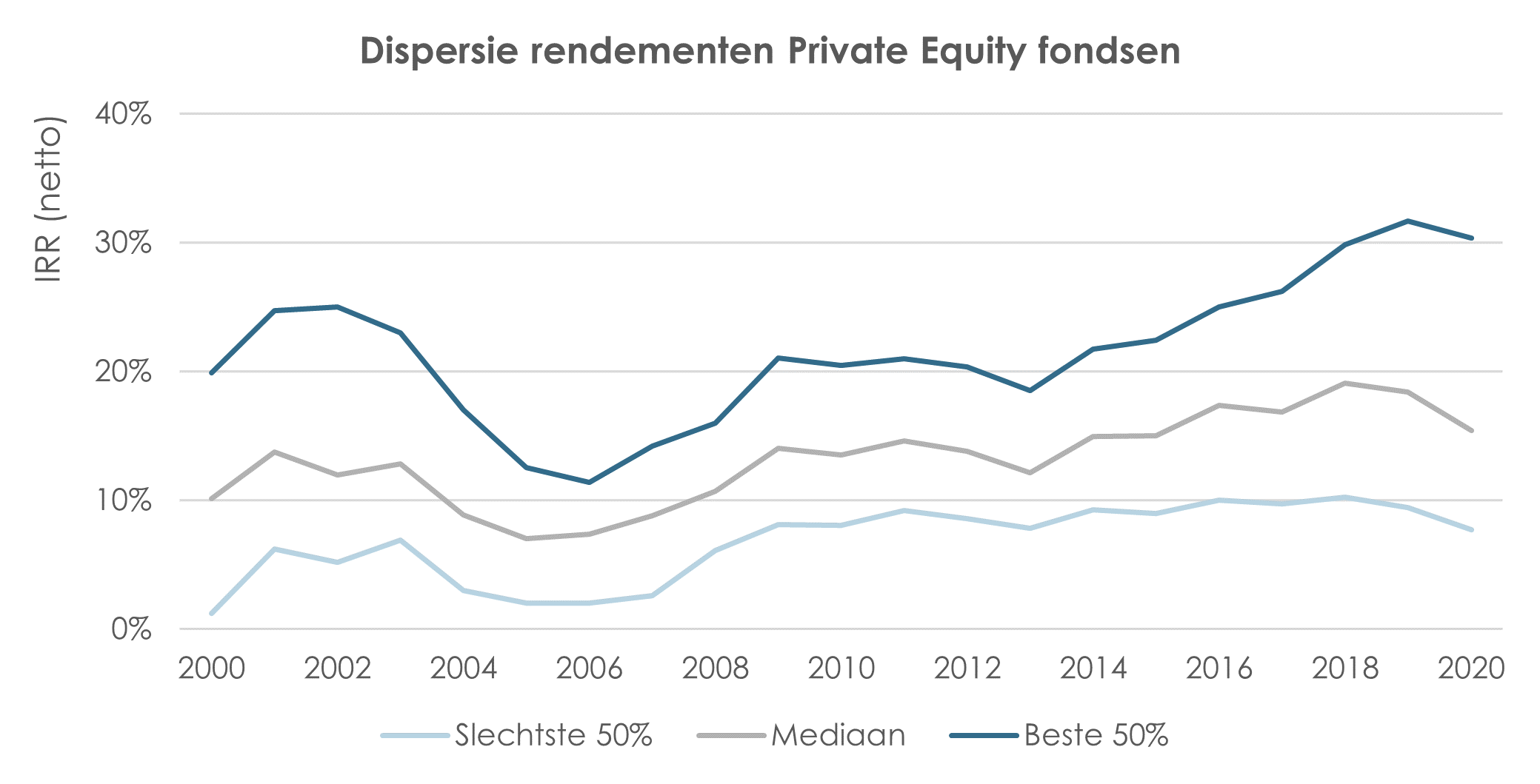

Een ander cruciaal aandachtspunt om omstuimige wateren te navigeren is managerselectie. In tegenstelling tot beleggen in beursgenoteerde aandelen, waar het relatief makkelijk is om rendementen van de brede markt te repliceren, geldt dat niet bij private equity. Zoals onderstaande grafiek toont, is de dispersie tussen managers groot. Zo is het rendementsverschil tussen de beste- en slechtste 50% managers bijna 16% (!) op jaarbasis. Zelfs het verschil tussen een gemiddelde manager en een bovengemiddelde manager is substantieel. Een gedegen due diligence proces is dan ook van groot belang. Investeerders dienen o.a. de samenstelling en ervaring van het team, de repliceerbaarheid van de strategie, de fondsvoorwaarden en het track record allen grondig te bestuderen.

Bron: Preqin Market Benchmarks

Conclusie

Helaas hebben investeerders geen glazen bol en blijft het gissen óf de vier uitdagingen daadwerkelijk de Vier ruiters van de Apocalyps blijken. Op de lange termijn blijft private equity echter een waardevolle toevoeging aan beleggingsportefeuilles. Het gediversifieerde karakter, de illiquiditeitspremie, en het vermogen van managers om actief waarde te creëren boven de publieke markt maken het een aantrekkelijke beleggingscategorie. Maar ongeacht de wateren waarin private equity zich bevindt, het belang van het juiste zeewaardige schip met een ervaren kapitein is evident.

Diederik Kappelle is associate bij Bluemetric, een adviseur voor onder meer family offices en één van de kennisexperts van Investment Officer.