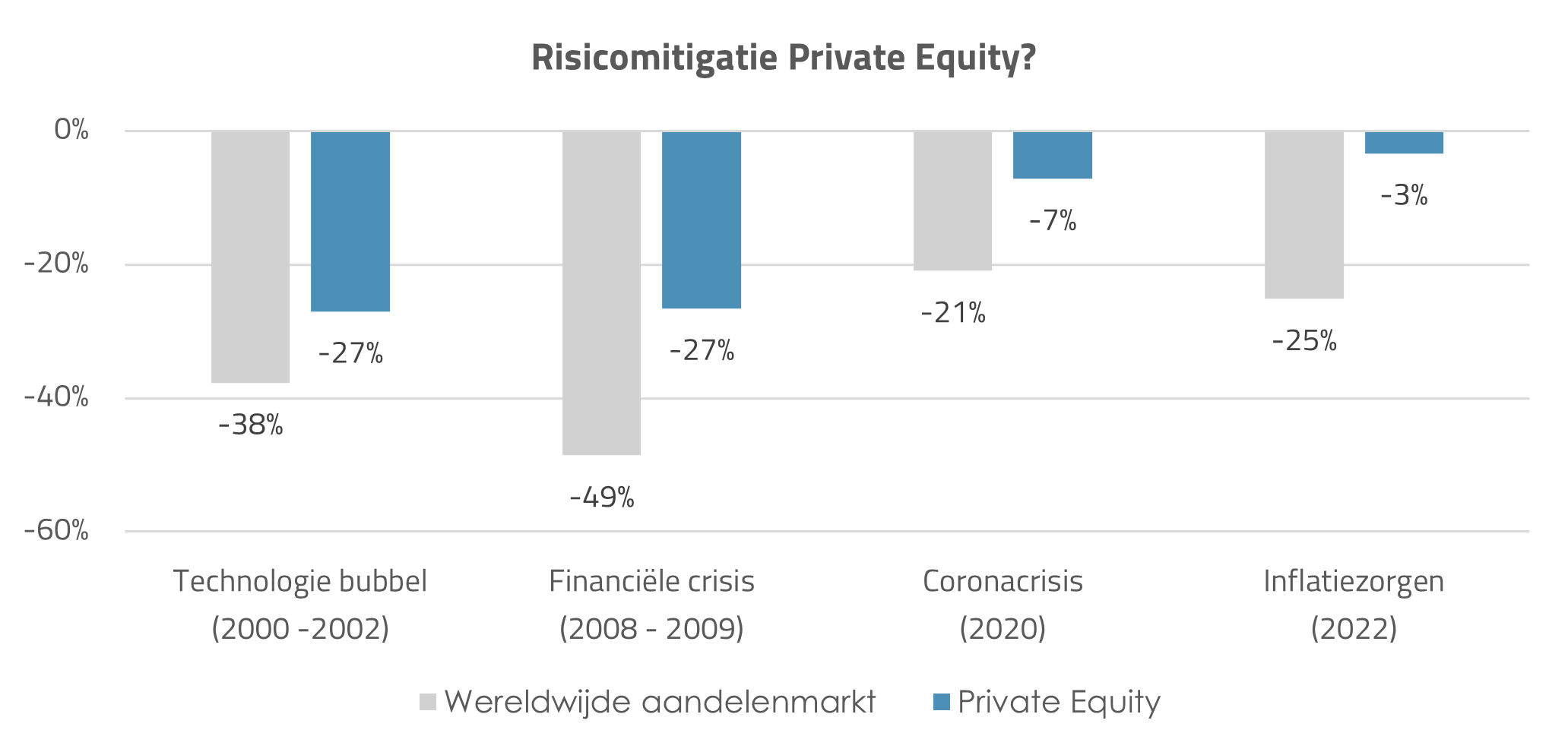

Wereldwijd beursgenoteerde aandelen daalden met ongeveer 25 procent in 2022, terwijl de wereldwijde private equity markt slechts een negatief rendement behaalde van 3 procent. Een opvallend contrast, aangezien beide markten te maken hadden met vergelijkbare uitdagingen van afvlakkende groei, hardnekkige inflatie en stijgende rentes.

Ieder vakgebied kent haar eigen veronderstellingen en theorieën. Binnen onze industrie zijn de meesten het (doorgaans) met elkaar eens over de volgende stellingen:

- Investeren draait om het bewust nemen van risico’s;

- (Enige mate van) diversificatie is verstandig;

- Risico en rendement zijn met elkaar verbonden; en

- ‘Het is moeilijk om voorspellingen te doen, vooral over de toekomst’ (Mark Twain)

Echter, de waarderingsverschillen tussen private en publieke markten zorgt momenteel voor verdeeldheid bij analisten, ook al was het gematigde negatieve rendement van private equity markten ook tijdens vorige crisissen duidelijk waarneembaar (zie onderstaande figuur). Zijn private equity beheerders in staat om het risico van hun bedrijven met hogere verschulding te beperken? Het simpele antwoord: ‘it depends’.

Bron: Preqin Quarterly Index, observaties per kwartaal & rendementen in USD.

Scylla & Charybdis

In de Griekse mythologie was Scylla een zeskoppig monster dat in de zeestraat tussen Italië en Sicilië op de loer lag, terwijl Charybdis een draaikolk betrof aan de andere kant van de zeestraat. Schepen die langs deze gevaren probeerden te navigeren, liepen het risico om door een van beide te worden gevangen. Deze mythe illustreert het spanningsveld waar investeerders in private equity zich in begeven. Enerzijds observeren zij gematigde (misschien onrealistische) prijsschommelingen in hun capital statements. Anderzijds horen ze Jim Cramer roepen ‘how bad it out there’ is.

Het ontbreken van de dagelijkse tucht van de markt betekent dat private equity beheerders hun deelnemingen grotendeels zelf dienen te waarderen. Hoewel waarderingsmethodieken enigszins zijn gestandaardiseerd, beschikken beheerders over veel flexibiliteit om hun rendementsontwikkeling te stabiliseren; het zogenaamde ‘return smoothing’. In de praktijk leidt dit tot een substantieel lagere volatiliteit van private markten vergeleken met publieke markten.

Voordat we kunnen concluderen of ‘u rustig kunt gaan slapen’, is het de vraag of prijsontwikkelingen in publieke markt dan helemaal niet relevant zijn. Marktefficiëntie is een kernbegrip voor economen om te beschrijven hoe goed beschikbare informatie is verwerkt in de waardering door Mr. Market. Het is redelijk is om te stellen dat marktprijzen een billijke prijsschatting bieden voor beleggers – idiosyncratische en korte termijn fluctuaties daargelaten. Wellicht dat een daling van 25 procent voor private markten afgelopen jaar excessief was geweest, maar 3 procent is mijns inziens een navigatiefout naar Scylla dan wel Charybdis. Zoals gewoonlijk ligt de juiste koers waarschijnlijk ergens in het midden.

De Gulden Middenweg

Hoeveel private markten ‘zouden moeten’ dalen is voor de meeste investeerders in de praktijk minder relevant. Belangrijker is wat de consequenties en remedies zijn voor een doordacht portefeuillebeheerproces. Optimisten verwijzen naar de voordelen die gepaard gaan met return smoothing zoals een beter langetermijnperspectief en lagere agency-kosten binnen de governance-structuur van institutionele beleggers.

De nadelen springen minder in het oog maar zijn daarmee niet minder belangrijk. Want ook voor investeerders met een lange horizon is het daadwerkelijke risicoprofiel van private equity nodig om een logische portefeuille te construeren. Helaas leidt return smoothing ertoe dat standaard risicomaatstaven zoals volatiliteit en correlaties bovenmatig gunstig lijken t.o.v. andere asset classes. Het gevolg is een te hoge portefeuilleallocatie aan private equity dan op grond van onderliggende economische aspecten gerechtvaardigd is. Het risicoprofiel kan worden bijgesteld door het incorporeren van statistische methodieken (e.g. correctie voor autocorrelaties en lagged beta). Echter, in de praktijk vormen portefeuille-limieten in combinatie met een doordacht en consistent allocatiebeleid de meest logische oplossing.

Daarnaast hebben de hoge historische rendementen in combinatie met lage (geobserveerde) risico’s geleid tot een significante instroom van kapitaal naar private equity fondsen. Sceptici wijzen erop dat daardoor de verwachte rendementen van de beleggingscategorie gemiddeld genomen fors onder druk komen te staan. Dit onderstreept het toenemende belang voor investeerders van een zorgvuldig proces om competente managers te selecteren.

Conclusie

Het is onwaarschijnlijk dat financiële professionals het eens gaan worden over de correcte prijsdaling van private equity. Ja, return smoothing heeft een impact. En ja, de publieke markt kan overreageren. Gelukkig worden bij private equity de medailles (i.e. carried interest) pas bij de finish uitgereikt en zullen investeerders monetair gezien beperkt geraakt worden door return smoothing. Tussentijds dienen investeerders niet ten prooi te vallen aan de nadelen van return smoothing, maar juist haar gedragsmatige voordelen te omarmen. Kortom, het identificeren van de gulden middenweg tussen Scylla en Charybdis biedt ook voor beleggers vandaag de dag een wijze les.

Koen van Mierlo is head of analysis bij Bluemetric, één van de kennisexperts van Investment Officer.